MSMEs are the backbone of many economies, particularly in developing countries. In India, for example, MSMEs contribute around 30% to the GDP and employ more than 110 million people. Despite their importance, MSMEs often struggle to access formal financial services, which hampers their growth and sustainability. Financial inclusion is crucial for MSME Registration for several reasons:

- Access to Capital:

One of the primary challenges faced by MSMEs is access to capital. Financial inclusion initiatives can help bridge this gap by providing MSMEs with access to formal banking services, credit facilities, and investment opportunities. This enables them to finance their operations, invest in new technologies, and expand their businesses.

- Risk Mitigation:

Financial inclusion can also help MSMEs mitigate risks by providing access to insurance products. Insurance can protect MSMEs from unforeseen events, such as natural disasters, accidents, or economic downturns, which could otherwise cripple their operations.

- Financial Literacy:

Financial inclusion initiatives often include financial literacy programs that educate MSMEs about managing their finances, understanding credit terms, and making informed investment decisions. This can help MSMEs make better financial decisions and improve their overall financial health.

- Increased Efficiency:

Access to digital financial services can improve the efficiency of MSMEs by reducing the time and cost associated with traditional banking transactions. Digital payment systems, for example, allow MSMEs to receive payments faster and manage their cash flow more effectively.

- Formalization of Business:

Financial inclusion encourages the formalization of businesses by integrating them into the formal financial system. This not only gives MSMEs access to financial services but also improves their credibility and trustworthiness in the eyes of investors, suppliers, and customers.

How To Apply For MSME Registration?

Step 1: Determine Eligibility

Before starting the registration process, ensure that your business meets the eligibility criteria for MSME registration based on investment and turnover limits. Gather necessary documents such as business address proof, bank account details, and identity proof of the business owner(s).

Step 2: Register on the MSME Portal

Visit the MSME registration portal and create an account by providing basic details such as your name, email address, and contact number.

Step 3: Fill in the Application Form

Log in to your account and fill in the MSME registration application form. Provide accurate information about your business, including:

- Business name and address

- Type of organization (e.g., proprietorship, partnership, company)

- Date of commencement of business

- Bank account details

- Investment in plant and machinery or equipment

- Annual turnover

- Number of employees

Step 4: Upload Supporting Documents

Upload scanned copies of the required documents, such as:

- Business address proof (e.g., utility bills, lease agreement)

- Identity proof of the business owner(s) (e.g., passport, driver’s license)

- Bank account details and statements

- Proof of investment in plant and machinery or equipment

- Balance sheets and profit & loss statements

Step 5: Submit the Application

Review the information in the application form and ensure all details are accurate. Submit the application form along with the supporting documents. Pay the required registration fee, if applicable.

Step 6: Verification and Approval

Once the application is submitted, it will be reviewed by the concerned authorities. They may verify the details provided and request additional information if necessary. The authorities will approve the application and issue an MSME registration certificate upon successful verification.

Challenges Faced by MSMEs in Accessing Finance

Despite the benefits of financial inclusion, MSMEs face several challenges in accessing finance. Some of the key challenges include:

- Lack of Collateral:

Many MSMEs lack the collateral required to secure loans from traditional financial institutions. This makes it difficult for them to access credit, even if they have viable business plans.

- High Perceived Risk:

Financial institutions often perceive MSMEs as high-risk borrowers due to their small size, limited financial history, and vulnerability to market fluctuations. As a result, they may be reluctant to lend to MSMEs or may offer loans at higher interest rates.

- Limited Financial Literacy:

Many MSMEs, particularly those in rural areas, lack the financial literacy needed to navigate the formal financial system. This can result in poor financial decisions, difficulty in understanding loan terms, and challenges in managing cash flow.

- Inadequate Financial Products:

Traditional financial products are often not tailored to the specific needs of MSMEs. For example, many MSMEs require small-ticket loans with flexible repayment terms, but traditional banks may only offer standard loan products with rigid terms.

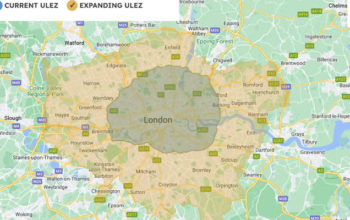

- Geographical Barriers:

MSMEs in rural or remote areas often face geographical barriers to accessing formal financial services. The lack of physical banking infrastructure in these areas can make it difficult for MSMEs to open bank accounts, apply for loans, or access other financial services.

Government Initiatives to Improve Financial Inclusion for MSMEs

Governments around the world, including in India, have recognized the importance of financial inclusion for MSMEs and have implemented various initiatives to improve access to finance for this sector. Some of the key government initiatives in India include:

- Pradhan Mantri Mudra Yojana (PMMY):

Launched in 2015, the PMMY scheme aims to provide credit to non-corporate, non-farm small/micro enterprises. Under this scheme, loans up to INR 10 lakh are provided by banks, non-banking financial companies (NBFCs), and microfinance institutions (MFIs). The scheme has three categories of loans: Shishu (up to INR 50,000), Kishore (INR 50,001 to INR 5 lakh), and Tarun (INR 5 lakh to INR 10 lakh), catering to different stages of business growth.

- Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE):

The CGTMSE scheme provides credit guarantees to banks and financial institutions, enabling them to lend to MSMEs without requiring collateral. This reduces the perceived risk for lenders and encourages them to extend credit to MSMEs. The scheme has been instrumental in improving access to credit for MSMEs that lack sufficient collateral.

- Stand-Up India Scheme:

This scheme aims to promote entrepreneurship among women and marginalized communities by providing loans between INR 10 lakh and INR 1 crore to at least one woman and one SC/ST entrepreneur per bank branch. The scheme also provides handholding support to entrepreneurs, including guidance on setting up businesses and obtaining licenses.

- Interest Subvention Scheme for MSMEs:

This scheme provides an interest subsidy of 2% on incremental loans up to INR 1 crore for MSMEs. The scheme aims to reduce the cost of credit for MSMEs and encourage them to borrow for business expansion and modernization.

- Udyam Registration:

The Udyam Registration portal is an online platform that simplifies the registration process for MSMEs. Registered MSMEs can access various government schemes, subsidies, and benefits, including priority lending from banks and financial institutions.

- Digital Financial Inclusion Initiatives:

The government has also launched various digital initiatives to promote financial inclusion, such as the Jan Dhan Yojana, which aims to provide bank accounts to unbanked individuals, and the Aadhaar-enabled payment system, which facilitates digital transactions. These initiatives have helped bring more MSMEs into the formal financial system and improve their access to financial services.

Private Sector Initiatives to Support Financial Inclusion for MSMEs

In addition to government initiatives, the private sector has also played a crucial role in promoting financial inclusion for MSMEs. Some of the key private sector initiatives include:

- Fintech Solutions:

Fintech companies have developed innovative financial products and services tailored to the needs of MSMEs. For example, digital lending platforms use alternative data sources, such as transaction history and social media activity, to assess the creditworthiness of MSMEs and provide quick, unsecured loans. These platforms have made it easier for MSMEs to access credit without the need for collateral.

- Digital Payment Platforms:

Digital payment platforms, such as Paytm, PhonePe, and Google Pay, have made it easier for MSMEs to accept payments digitally and manage their cash flow. These platforms also offer additional financial services, such as short-term loans and insurance products, to help MSMEs manage their finances more effectively.

- Supply Chain Finance:

Supply chain finance solutions allow MSMEs to access working capital by leveraging their receivables. For example, invoice discounting platforms enable MSMEs to sell their invoices to financiers at a discount and receive immediate payment. This helps MSMEs improve their cash flow and manage their working capital needs without taking on additional debt.

- Corporate Partnerships:

Large corporations have partnered with financial institutions and fintech companies to provide financial services to MSMEs in their supply chains. These partnerships often include access to credit, digital payment solutions, and financial literacy programs, helping MSMEs improve their financial health and become more resilient.

- Microfinance Institutions (MFIs):

MFIs play a vital role in providing financial services to MSMEs, particularly in rural and underserved areas. MFIs offer small loans, savings products, and insurance to MSMEs who may not qualify for traditional banking services. By offering flexible loan terms and minimal documentation requirements, MFIs have made it easier for MSMEs to access the finance they need to grow their businesses.

Note: Now you can print udyam certificate through udyam portal.

Conclusion

Financial inclusion is a critical enabler for the growth and sustainability of MSMEs. By providing access to formal financial services, financial inclusion initiatives empower MSMEs to overcome the challenges of limited capital, high risk, and inadequate financial literacy. These initiatives not only enhance the financial health of MSMEs but also contribute to their formalization, making them more credible and resilient. Therefore, continued efforts to promote financial inclusion are essential to unlocking the full potential of MSMEs, ensuring they remain a dynamic force in the global economy.